Redefining Management Liability Underwriting with Copilot

We have exciting news - we are thrilled to announce support for Management Liability Insurance within our Copilot underwriting workbench. By continually expanding the risks we support, we advance our mission of helping every underwriter Bind with Confidence.

Management liability is a vital new pillar of Copilot’s offering, joining an existing arsenal that’s delivered record improvements across the commercial space. Copilot already had an established track record, supporting leading insurers in excess and surplus lines, primary casualty, property, and commercial auto risks.

After launching our fleet offering last summer, we set right to work on a solution to support management liability for our existing customers. Several months of beta testing later, we are excited to make the news public and bring additional insurers into the fold.

Why Management Liability?

It’s an interesting time in the management liability space.

After years of rapidly escalating rates, the market has finally begun to soften. However, changing market dynamics and global financial slowdowns have brought other concerns into play.

While new insurers have entered the marketplace in the past two years, IPOs and SPACs have slowed to a crawl, hamstringing the growth of public company business. As a result, insurers are increasingly relying on great customer service and pricing to win the new business that does exist, and retaining existing business has become paramount. With a financial downturn possibly on the horizon, insolvencies, layoffs, and bankruptcies may be on the rise, leading to an uptick in D&O claims.

Meanwhile, management liability underwriters are facing many of the same challenges encountered in other lines of business. Quote rates, response times, and underwriting quality suffer under the weight of time spent on admin tasks - 40% of underwriters’ time, according to Accenture. At the same time, managing submissions out of an email inbox or a clunky, outdated system slows down quoting, hampers response rates, and damages relationships with distribution partners. In addition, underwriters’ constant struggle to find crucial information - including company financials, OSHA violations, news of criminal activity, and digestible loss histories -leads to mispriced risks and poor underwriting.

That’s where we come in.

How Does Copilot Help?

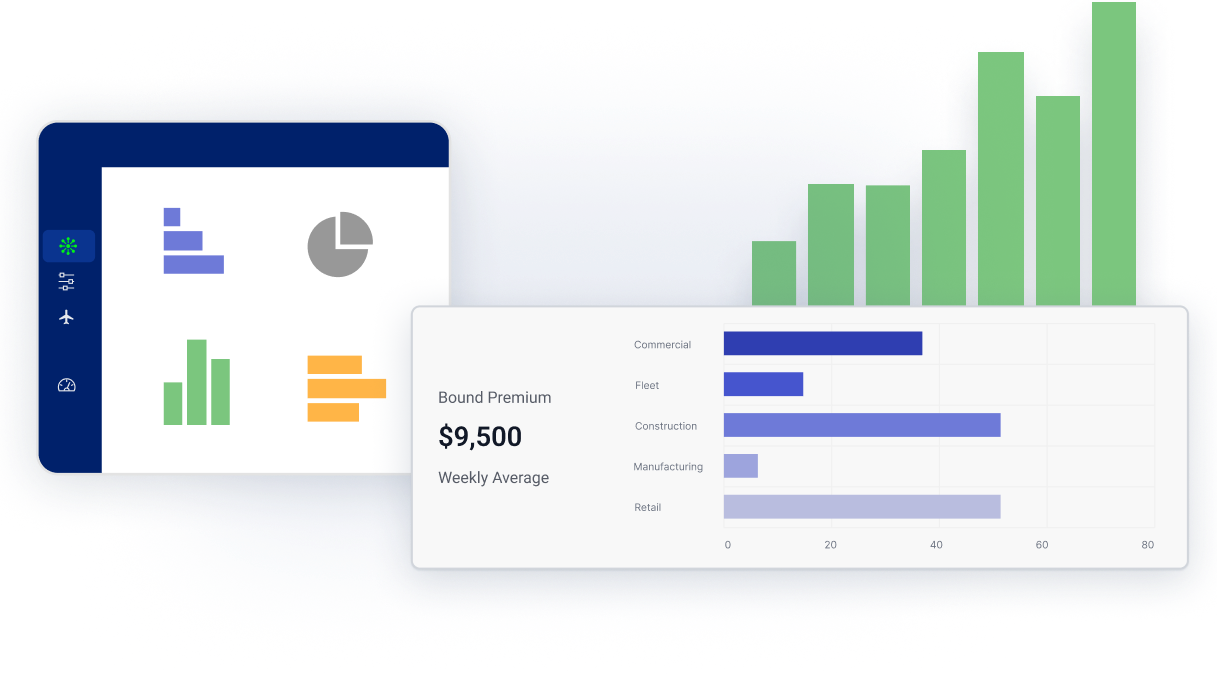

Copilot offers the features that underwriters and underwriting leaders need to take control of their management liability books.

Instant submission ingestion

Stop scanning through dozens of PDF pages and trying to keep track of broker emails. Copilot extracts everything you need from loss runs, ACORD forms, SOVs, emails, financial statements, and more. No need to bog down underwriters with correcting every extraction - Copilot results are the most accurate in the industry, so you can be confident in every single output.

Every submission in one place

Manage all of your submissions from one central Hub, where you can quickly filter to high priority risks or search for the exact submission you want to find. Preview a submission summary before diving in and decline out-of-appetite risks with a single click.

.png)

Get the insights you need

Copilot reports bring the critical information straight to you. Get instant access to risk analysis of all stripes: Regulatory violations, legal filings, news of criminal activity and fraud, bankruptcies, regulatory violations, company ownership structures and financials, loss histories, and much more. All of this so you can make better decisions, faster.

.png)

Manage Your Book with Ease

Get full visibility into your book in real time. Whether you’re an individual underwriter looking to measure your performance, or a CUO who wants to take it all in - we’ve got you covered.

How Do We Get Started?

At Kalepa, our mission is to make commercial underwriting better. That means better for underwriters, better for brokers, better for policyholders, and better for carriers. With Copilot supporting a wide-reaching variety of industries and lines of business - now including management liability - we’re helping underwriters Bind with Confidence across the board.

Want to see how Copilot can transform your management liability underwriting from day one? Set up a demo to get started.

Still not convinced? Find out why we were named one of the most innovative insurtechs by FinTech Global, read more about Copilot here, or learn how Copilot helped one top 10 carrier improve combined ratio by 10%.

.png)